Japan Property Tax for Foreigners

Japan property tax guide for foreigners: Learn the key taxes on buying, owning, and selling property in Japan. Avoid surprises—read before you invest!

Table of Contents

“Interested in Japanese real property but not sure about the tax implications?”

“Would like to know more about the taxes involved in buying, selling, holding, or leasing a property in Japan?”

Property in Japan has become increasingly popular among foreigners, but buying, holding, leasing, and eventually selling a property always comes with tax costs.

This article will guide you through the tax implications of owning property in Japan as a foreigner, ensuring you are well-informed about the taxes you will be required to pay.

Please read through if you are interested in or planning to invest in Japan property.

Japan Property Taxes for Foreigners in 4 Investment Stages

We will now explain Japanese taxes that a foreigner needs to bear in mind when investing in Japan real estate in the following 4 investment stages:

- When Buying a property

- While holding a property

- When renting out your property

- When selling your property

1.When buying a property in Japan

When buying a property in Japan, whether you are a foreigner or a Japanese, you will need to pay the following taxes:

- Real Estate Acquisition Tax - 3%

- Consumption Tax - 10%

- Stamp Tax/Duty - usually JPY20,000 to JPY100,000

- Registration and License Tax - 0.4% - 2%

Real Estate Acquisition Tax (不動産取得税, fudosan-shutoku-zei)

This is a 3% tax that is imposed on the assessed value of the property only once when land or properties are purchased.

The usual tax rate is 4%, but now the reduced tax rate of 3% applies to land and residential buildings acquired between April 1, 2008 and March 31, 2027.

The buyer is required to pay the tax within 30 days to 60 days (depending on the municipality where the property is located) based on an invoice from the local government.

Source: Bureau of Taxation, Tokyo Metropolitan Government

Consumption Tax(消費税, shohi-zei)

This is a one-time tax on the sale of a building (not the land).

Currently, the tax rate is 10%. Usually the buyer pays it.

When you are purchasing a used house from an individual (not from a company who is a Taxable Enterprise), you may not have to pay this tax.

Source: National Tax Agency

Stamp Tax/Duty(印紙税, inshi-zei)

This tax is calculated on a sliding scale, with the lowest rate being 200 yen for real estate contracts under JP¥ 100,000 and the highest rate being 600,000 yen for contracts over 5 billion yen.

However, reduced tax rates apply to real estate contracts executed between April 1, 2014 and March 31, 2027.

<Usual Rate and Reduced Rate of Stamp Duty on Real Estate Contracts>

Contracts under 10,000 yen are tax-exempt, while contracts between 10,000 yen and 100,000 yen, or those with no price specified, are subject to a 200 yen tax.

Source: National Tax Agency

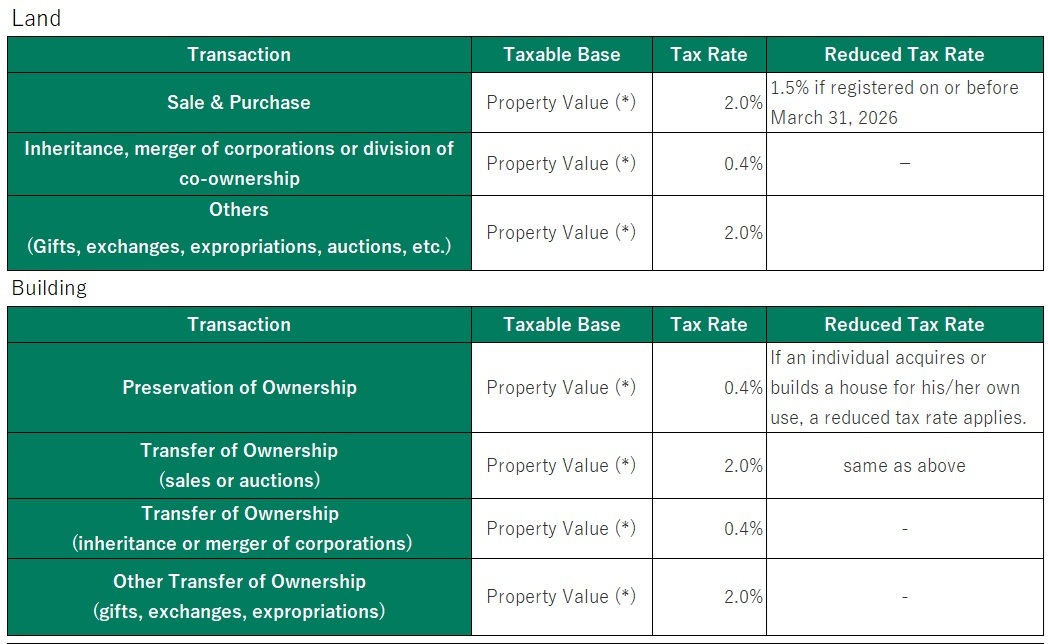

Registration and License Tax(登録免許税, toroku-menkyo-zei)

This is a tax that ranges between 0.4% and 2%, depending on the type of transaction and the assessed value of the property, which is usually lower than the actual market price. This is a one- time payment at registration.

If you are buying a property for you to actually live in, a reduced tax rate applies if it is registered before March 31, 2027.

(*) The “Property Value” is, in principle, the value registered in the fixed asset taxation registry maintained by the municipal office. If there is no value registered in the fixed asset taxation registry, it is the value assessed by the registrar.

The applicable tax is calculated by the judicial scrivener (Shiho Shoshi), who handles the property registration process.

The buyer bears the fee for the judicial scrivener.

Source: National Tax Agency

Our team of seasoned professionals at PropertyAccess is dedicated to helping you navigate Japan’s real estate market with confidence.

With deep local knowledge and a commitment to personalized service, our experts are here to guide you every step of the way.

Book a Free Consultation Session with Our Team

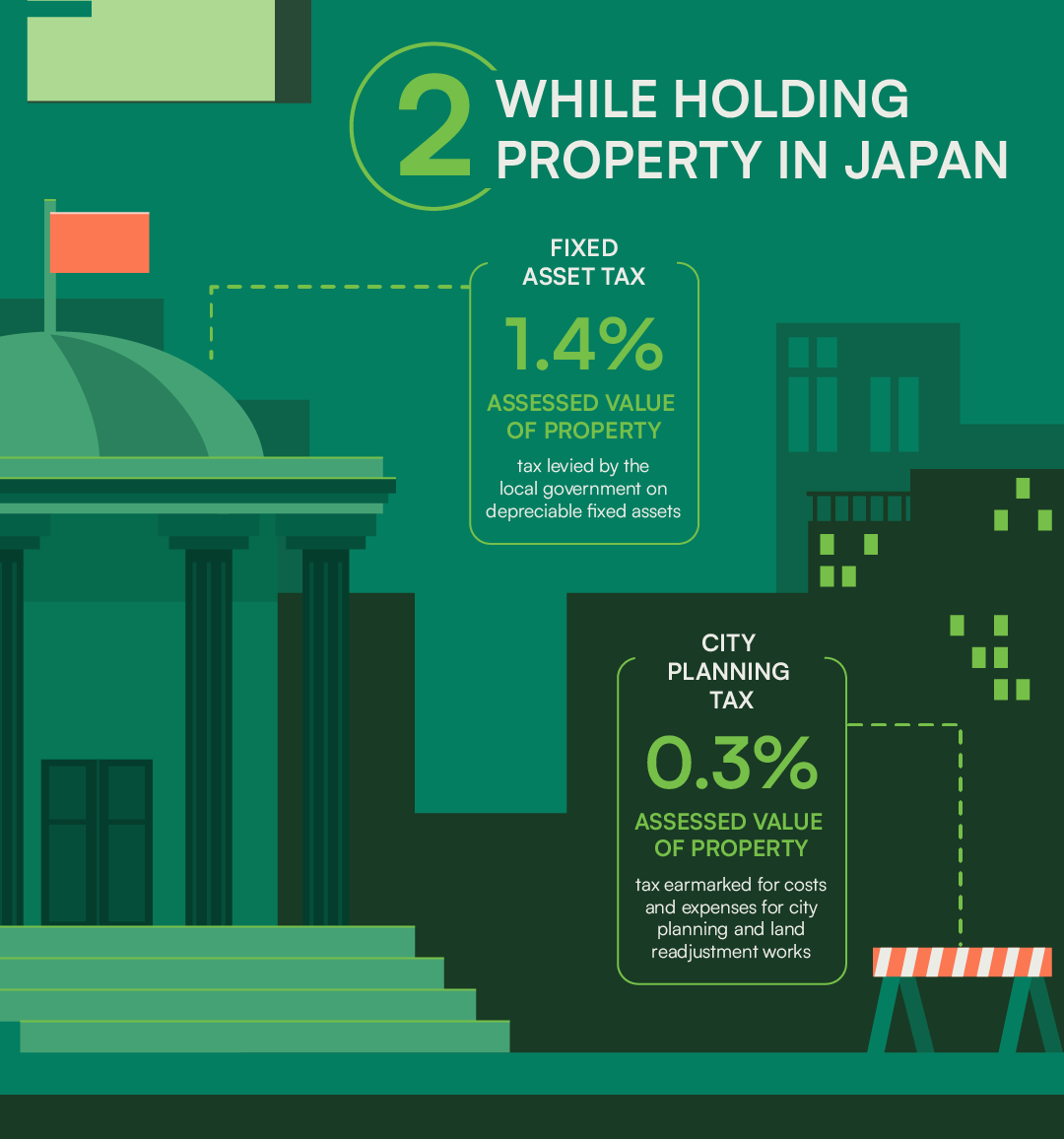

2. While holding a property in Japan

Once you buy a property, there are two types of taxes while you hold the title to the property:

- Fixed Asset Tax - Assessed value of property x 1.4%

- City Planning Tax - Assessed value of property x 0.3% (capped rate)

Fixed Asset Tax: Assessed value of property x 1.4%

Fixed asset tax is a tax levied by the local government on land, buildings and other depreciable fixed assets.

The assessed value of property is determined by the municipality where the property is located.

◆ Who pays it?

The person who owns the property as of the first day of January each year is liable for the payment of this tax.

◆ When to pay?

It is an annual tax but the payment is usually made in four installments (paid in June, September, December and February) in one financial year.

◆ If the property is transferred during a year?

The seller is still responsible for the payment of the gross tax amount while it is common that the buyer reimburses a part of it that corresponds to the period of the buyer’s ownership in the year.

For example, if the property is transferred to the buyer at the end of June, the seller still pays the gross tax amount to the local government while the buyer pays the seller a half of the amount.

City planning tax: Assessed value of property x 0.3% (capped rate)

◆ What is the city planning tax?

City planning tax is a tax earmarked for costs and expenses for city planning works and land readjustment works carried out by the municipality.

City planning tax is not levied if the property is located in “Urbanization Control Areas (市街化調整区域, shigaika chosei kuiki)” and “Areas outside of City Planning Zones(都市計画区域外, toshikeikaku kuiki gai).”

◆ Who pays it?

This tax is levied on the owner of land and buildings within any Urbanization Promotion Area(市街化区域, shigaika kusiki) designated by the municipality.

◆ When to pay?

It is paid together with fixed asset tax, in four installments throughout the year.

These taxes are payable by the owner of the property regardless of whether you reside in Japan or not.

If you are a non-resident of Japan, you will need to appoint a “Tax Agent” who is a resident of Japan and can pay the taxes on your behalf.

Once you have a Tax Agent, you are required to notify the local tax office with jurisdiction over the property by submitting a form called 'Notification of Tax Agent.'

Other fees to maintain the property:

Each condominium building must have a management association composed of all the condominium owners.

The condominium management association is established for the purpose of managing and maintaining the building, but usually outsources part or all of the management and maintenance work to a property management company.

Management fee

This fee is charged for the management and maintenance of the common area of the building, such as utility bills and janitorial service, fees to replace lighting bulbs, fire insurance, and also commission paid to the property management company.

Repair Reserve Fund

A repair reserve fund is a fund set aside for major building repairs to maintain the value of the building for a long period of time.

◆ Who pays the fees?

Each condominium owner does.

The amount of these monthly payments varies depending on the property but in many cases, the total of these two payments is around 30,000 yen to 40,000 yen monthly.

In our recent transaction, the subject property was a luxury condominium unit in a prime location of Tokyo.

The management fee was around 35,000 yen and the repair reserve fund was around 15,000 yen monthly.

◆ When to pay?

Usually, the fees are charged monthly and directly deducted from your bank account.

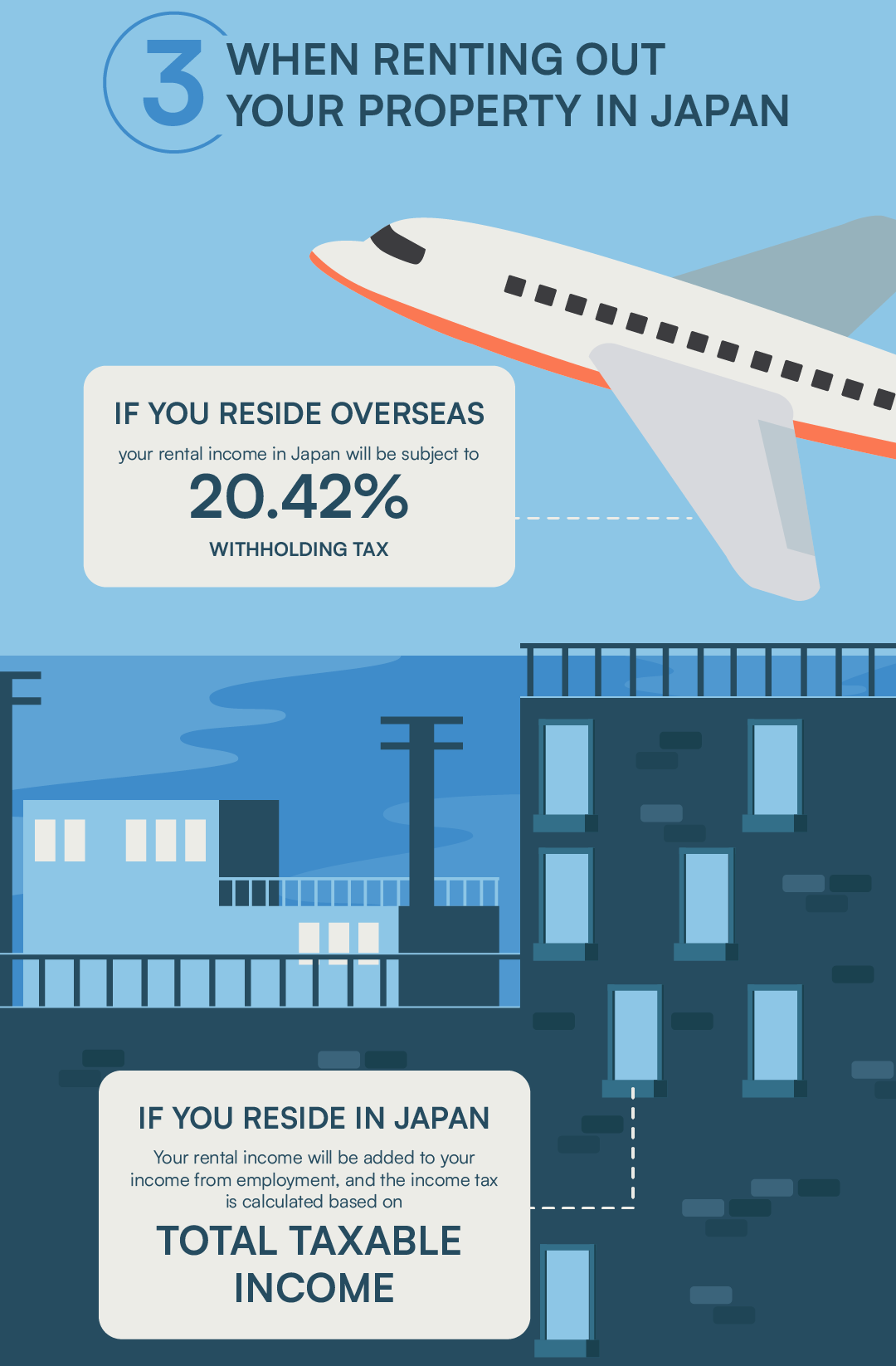

3. When renting out your property in Japan

When renting out your property in Japan, an income tax is imposed on rental income, in addition to the taxes and fees to be paid while holding the property.

This tax is imposed only when you get rental income from the property you rent out.

The rental income becomes part of your taxable income (if applicable) in Japan and is subject to income tax.

How you pay the tax differs depending on whether you are a resident of Japan or not.

(1) If you reside in Japan: Income tax return filing

Income tax = (Total taxable income – deductions) x income tax rate(*) – tax credit

◆ Who pays it?

You will be responsible for the payment.

Your rental income will be added to your income from employment and other sources (total taxable income) and the income tax is calculated based on the total taxable income.

◆ When to pay?

You are required to file your income tax return and pay the total income tax for the year (from January 1st to December 31st) within the period from February 16th to March 15th of the following year.

◆ How is the tax rate determined?

Depending on the amount of your total taxable income, the tax rate to be applied (5% to 45%) and the tax credit available vary.

◆ How do I calculate my rental income?

The amount of your rental income for tax purposes is calculated by deducting necessary expenses from the gross rental income.

The necessary expenses here include taxes when purchasing the property (such as Registration and License Tax and Real Estate Acquisition Tax) and holding the property (such as Fixed Asset Tax, City Planning Tax), insurance premiums, depreciation expenses, repair costs, etc.

(2) If you reside overseas: 20.42% withholding tax + final tax return filing

◆ Who pays it?

If you are a non-resident of Japan, the rental income from your property located in Japan will be subject to a withholding tax of 20.42%.

But in this case, the tenant, whether being an individual or a corporation, has the obligation to withhold and pay the tax amount from the rents before paying the rest to you.

◆ When to pay?

The tenant pays the tax by the 10th day in the following month of the rent payment.

◆ Are there any exceptions?

If the tenant is an individual and rents your property for himself/herself or his/her relatives to live in, no withholding tax will be imposed.

When you submit the final tax return, your withholding tax amount will be settled so that the final tax amount becomes equal to what you would have paid if you lived in Japan.

If you are a non-resident of Japan, you will need to appoint a “Tax Agent” who is a resident of Japan and can file the final tax return on your behalf.

Once you have a Tax Agent, you are required to notify the local tax office that has jurisdiction over the property by submitting a form called “Notification of Tax Agent”.

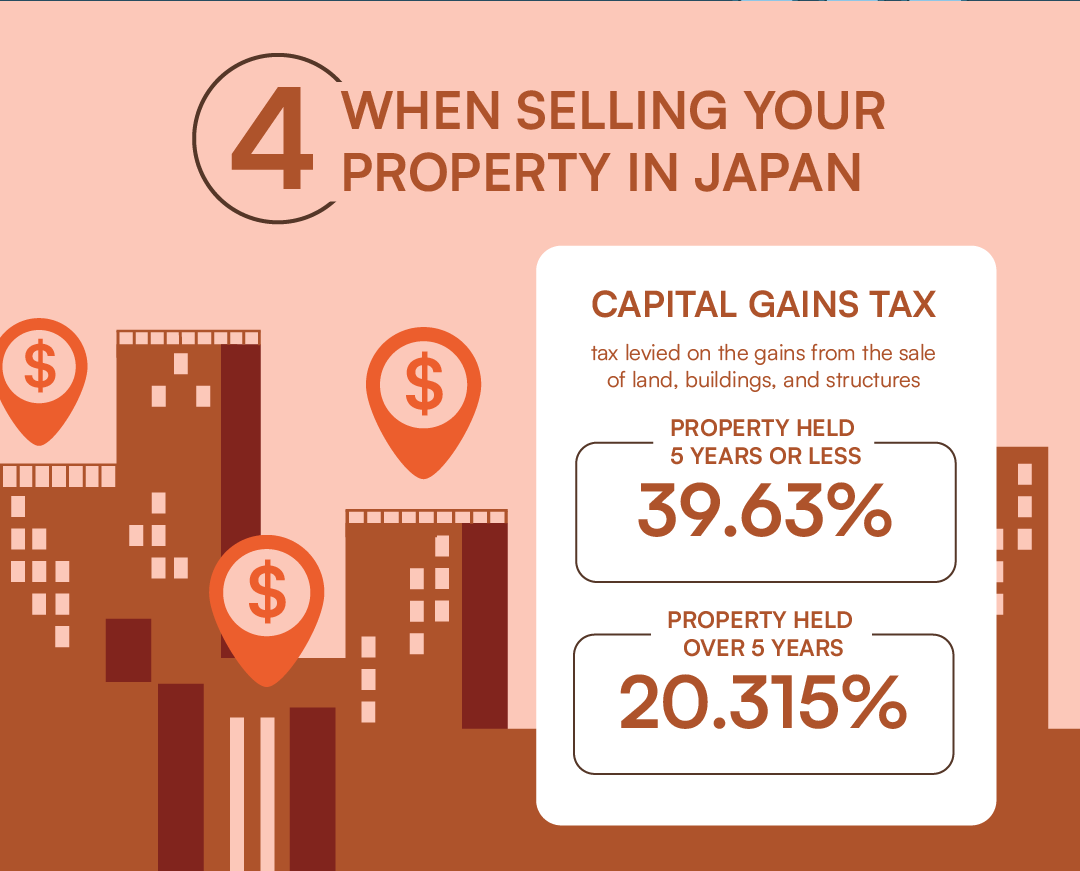

4. When selling your property in Japan

When selling a property in Japan, you will need to pay tax on gains from the sale (if any), as well as other taxes such as stamp duty and Registration and License Tax.

- Capital Gains Tax - 20.315% (property held over 5 years) or 39.63% (5 years or less)

- Stamp Duty - regardless of whether you have gains or not

- Registration and License Tax - regardless of whether you have gains or not

Capital Gains Tax: (Sale price - [costs of acquisition + expenses of sale]- special deduction) x tax rate

◆ What is capital gains tax?

Capital gains tax is a tax levied on the gains from the sale of land, building and structures.

The gains here are not the amount of money you receive from the buyer but the amount after deducting, from the sale price, the costs and expenses you paid to acquire and transfer the property.

If you have lived in the property as your primary residence, special deduction will be applied.

The tax rate is determined depending on the use of the property and the length of your ownership.

◆ Who pays it?

The seller of the property is responsible for the payment.

If the seller incurs loss from the sale, there is no need to pay this tax.

◆ When to pay?

The seller must submit a tax return and pay the tax during the tax filing period (between February 16th and March 15th) of the year following the year in which the sale took place.

◆ How is the tax rate determined?

Capital gains are classified into two classes: long-term capital gains and short-term capital gains.

When the sale is completed, if you have held the property over 5 years as of January 1st of the year, the gains from such sale are considered as long-term capital gains.

Long-term capital gains are taxed at a flat rate of 20.315% (15.315% national tax & 5% local inhabitant’s tax).

If you have held the property for 5 years or less as of January 1st of the year, the gains from such sale are considered as short-term capital gains.

Short-term capital gains are taxed at a flat rate of 39.63% (30.63% national tax & 9% local inhabitant’s tax).

Please take note that the 5-year ownership criterion applies to the length of ownership as of January 1st of the year when the sale takes place.

Let’s look at this example: you purchased a property in June 2018 and want to sell it in July 2023.

In July 2023, you will have held the property for 5 years, but as of January 1st 2023, you will have owned the property less than 5 years.

This means the gains from the sale will be categorized as short-term capital gains and taxed at 39.63%.

◆ What if I don’t live in Japan?

Even if you are a non-resident who does not have a resident address in Japan nor have lived in Japan consecutively for one year, you will have to submit a tax return and pay capital gains tax from your sale of property.

Like the payment of Fixed Asset Tax and City Planning Tax, you will need to appoint a “Tax Agent” who is a resident of Japan and can pay this tax on your behalf.

Once you have a Tax Agent, you are required to notify the local tax office that has jurisdiction over the property by submitting a form called “Notification of Tax Agent”.

Stamp Duty

Revenue stamp needs to be affixed on the contract of sale and purchase, and the amount of the stamp duty depends on the amount of the sale price written in the contract.

Currently, contracts prepared between April 1st 2014 and March 31st 2027 for property the price of which exceeds 100,000 yen are subject to a reduced tax rate.

◆ Who pays the fees?

The person who prepares the contract is liable for the payment.

In case of a sale and purchase transaction of property, both the buyer and the seller are equally liable.

Usually, there is a provision in the contract that the seller and the buyer evenly share the stamp duty, since the agreement is made upon mutual agreement between them.

◆ When to pay?

Stamp duty is payable when the contract of sale and purchase is executed.

The stamps are available at post offices and Legal Affairs Bureau offices.

Registration and License Tax: Assessed value of property x 2%

This tax becomes due when the ownership of property is transferred to the buyer.

◆ Who pays the fees?

It is common that the buyer bears this tax, since the buyer is considered as the beneficiary of the transfer.

◆ When to pay?

This tax is paid when the transfer of ownership is registered.

Whether your purchase is for investment purposes or for personal use, even if you don’t plan to sell the property in the near future, keeping the exit costs in mind helps you avoid the feeling of 'this is not what I expected.

Summary

In this article, we looked at the tax implications of Japanese property in the following 4 stages of investment:

- When buying a property in Japan

- When holding a property in Japan

- When renting out your property in Japan

- When selling your property in Japan

When you buy a property in Japan, you will need to pay the following taxes:

- Real Estate Acquisition Tax - 3%

- Consumption Tax - 10%

- Stamp Tax/Duty - usually JPY20,000 to JPY100,000

- Registration and License Tax - 0.4% - 2%

While holding a property in Japan, you are responsible for the following payments:

- Fixed Asset Tax - Assessed value of property x 1.4%

- City Planning Tax - Assessed value of property x 0.3% (capped rate)

- Apart from these taxes, the management fee and repair reserve fund are payable monthly (condominium unit).

When you rent out your property and gain rent income, you need to pay the following tax:

- Income Tax - 5% to 45% depending on the taxable income

When selling your property in Japan, you will have to pay the following taxes.

- Capital Gains Tax - 20.315% (property held over 5 years) or 39.63% (5 years or less)

- Stamp Duty - regardless of whether you have gains or not

- Registration and License Tax - regardless of whether you have gains or not

These taxes are not so different from those in other countries; however, filing a tax return can be quite complicated, especially when you are overseas.

It is advisable that you consult with a property agent or firm that has rich experience in property transactions with foreigners.

Our team of seasoned professionals at PropertyAccess is dedicated to helping you navigate Japan’s real estate market with confidence.

With deep local knowledge and a commitment to personalized service, our experts are here to guide you every step of the way.

Book a Free Consultation Session with Our Team