A Complete Guide to Buying Property in Japan

Here are some compelling reasons why foreigners should consider purchasing real estate in this fascinating country.

Table of Contents

In recent years, Japan has become an increasingly attractive destination for foreign property buyers. Whether you're looking for an investment opportunity, a vacation home, or a place to retire, buying property in Japan offers numerous benefits. Here are some compelling reasons why foreigners should consider purchasing real estate in this fascinating country.

1. There are no restrictions on foreigners when buying Japan property.

There are no restrictions on foreigners buying property in Japan, making it an attractive market for international investors. Whether you're looking to purchase land, houses, or condominium units, you can do so without facing tough hurdles or limitations. The process is straightforward and transparent, allowing you to invest with confidence.

This allows for a wealth of opportunities for investors like you who are looking to expand their property portfolio, secure a vacation home, or even settle down in Japan. With this set up, you can start investing in Japanese real estate and experience a seamless and rewarding experience as an overseas investor.

| Bank | Tenure | Interest | |

|---|---|---|---|

| SBJ Bank | 25 years | 1.5 - 2.5% | Japanese corporations, all nationalities |

| HANA Bank | 25 years | 2 - 3% | Japanese corporations, all nationalities |

| SBI Shinsei Bank | 25 years | 2.5 - 3.5% | Japanese corporations, all nationalities |

| Tokyo Star Bank | 25 years | NA | Individuals, only for Taiwanese |

After acquiring a Japanese corporation, you will be able to apply for management visa (1-2 years work permit).

2. Loans are available for foreign buyers.

Foreigners can take out a bank loan to purchase property in Japan, making it easier to finance your investment. We can introduce you to four reputable banks that offer loan services tailored to the needs of international buyers. These banks are experienced in dealing with foreign investors and can provide competitive loan options to help you secure your desired property.

Typically, these bank loans can cover up to 50% of the property's purchase price, providing substantial financial support while requiring a reasonable down payment. This financing flexibility allows you to invest in Japanese real estate without needing to pay the full amount upfront, thereby preserving your liquidity and enabling you to manage your finances more effectively.

With these banks, you can take advantage of favorable loan terms and interest rates, ensuring that your investment in Japan is both affordable and profitable. Our team will guide you through the loan application process, helping you gather the necessary documentation and liaising with the banks to secure the best possible financing for your property purchase.

3. Investing in Japan is highly transparent.

Japan has strict laws and regulations governing real estate transactions, ensuring a high level of buyer protection. One of the key protections for buyers is the seller's liability for contractual non-conformity, which can range from 2 months to 2 years depending on the agreement. This means that if the property has any defects or issues that were not identified at the time of purchase, the seller is responsible for addressing them within this period.

4. Japan has low interest rate environment which is perfect for real estate investment.

Interest rates in Japan are remarkably low, making it common for individuals in their 20s and 30s to utilize home loans for real estate investments. With interest rates often below 1%, among the lowest globally, the market is highly attractive to investors.

This low-interest-rate environment is anticipated to sustain strong housing demand and stabilize future home prices.

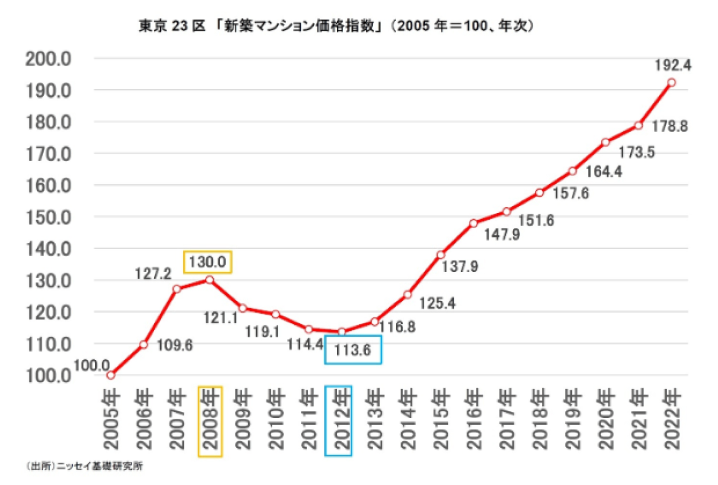

The graph below illustrates the residential prices in Tokyo since 2005, showing an upward trend beginning in 2012. This increase can be attributed to the low interest rates and the monetary easing policies implemented during that period.

5. There are relatively low property prices relative to the income level.

The house price-to-income ratio in Tokyo (Japan) demonstrates that property prices are relatively lower compared to other major cities worldwide.

This ratio, derived by dividing the median house price by the average household disposable income, indicates the number of years' worth of income needed to purchase a home.

Given that property prices in Tokyo remain lower than in many other global cities, there is potential for future price appreciation.

Price-income ratio (PIR)

| City | PIR |

|---|---|

| Shanghai, China | 46.6 |

| Beijing, China | 45.8 |

| Hong Kong, Hong Kong (China) | 44.9 |

| Shenzhen, China | 40.1 |

| Manila, Philippines | 37.6 |

| Mumbai, India | 36.6 |

| Ho Chi Minh City, Vietnam | 34.5 |

| Bangkok, Thailand | 31.5 |

| Seoul, South Korea | 30.8 |

| Jakarta, Indonesia | 20.3 |

| Tokyo, Japan | 12.6 |

In Summary

- There are no restrictions on foreigners when buying Japan property.

- Loans are available for foreign buyers.

- Investing in Japan is highly transparent.

- Japan has low interest rate environment which is perfect for real estate investment.

- There are relatively low property prices relative to the income level.